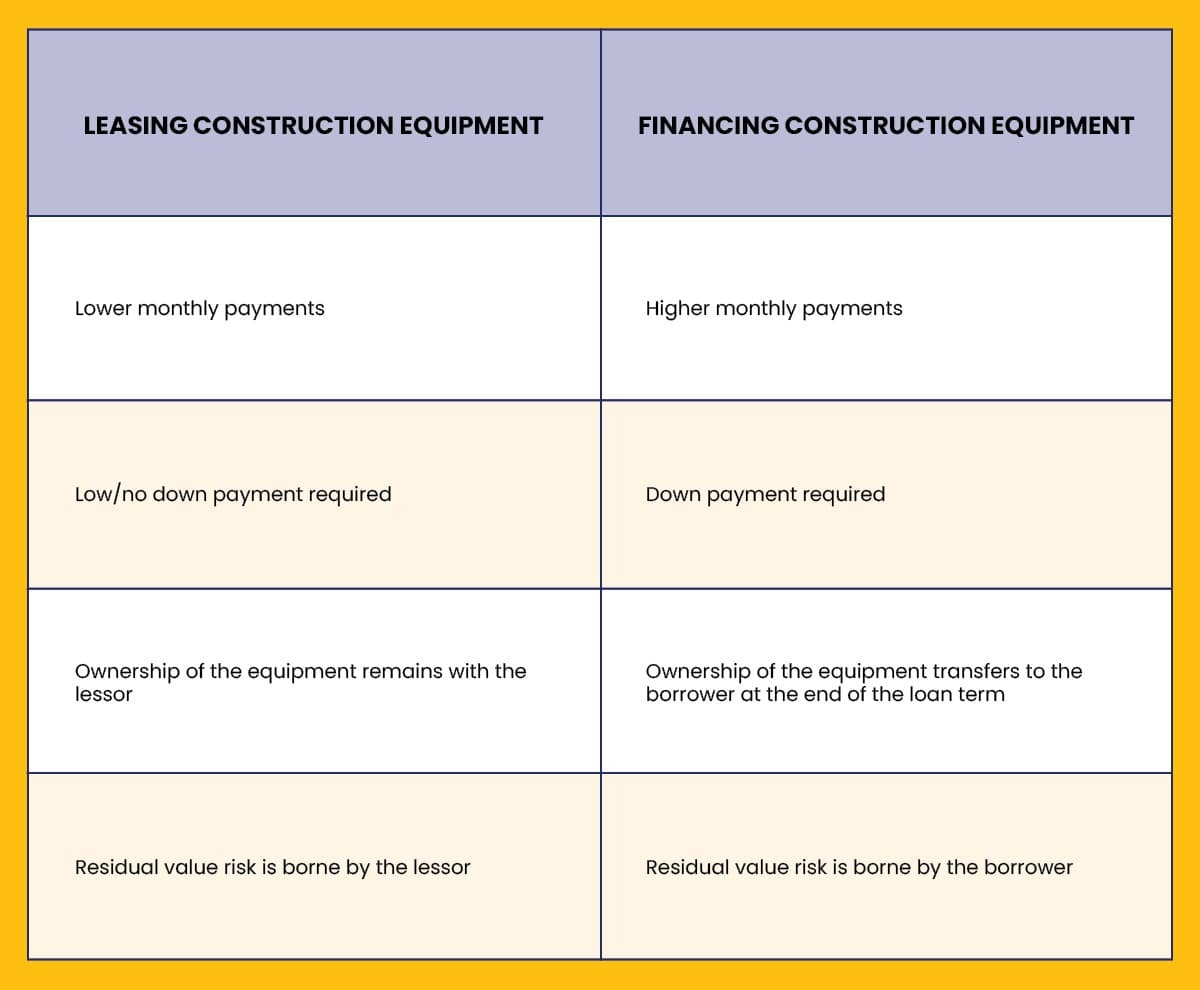

While we always recommend doing the proper research before making a decision as consequential as great as buying or leasing construction equipment, here is a quick “too long, didn’t read” (TL;DR) version of some of the points made.

Need additional details?

We cover all of these points in detail throughout this guide, so keep reading!

So, you’re in need of construction equipment but you’re having trouble deciding between leasing or buying your gear. What’s the big deal, anyway? Both outcomes result in getting the job done…right?

Well, almost.

The decision to buy or lease construction equipment is one that can significantly affect your company's cash flow, operational flexibility, and profit margins for years.

The aim of this guide is to provide the data necessary for you to make an informed decision when it comes to leasing or buying your construction equipment.

Looking for construction equipment to buy versus lease differs slightly when it comes to inspecting equipment for quality.

The buying process for construction equipment demands thorough research and substantial initial investment. You want to make sure that the equipment you’re buying provides the maximum amount of value—both as a reliable machine as well as fetching a decent resale price when it's time to upgrade. For this reason, it is recommended to have any used construction equipment you plan to purchase inspected by a professional construction equipment mechanic. Though this will likely cost a few hundred bucks, said inspection may save you thousands down the road.

On the other hand, leasing construction equipment typically involves less, if any, upfront cost and the ability to upgrade models as needs change. For this reason, the history of the construction equipment leased is less consequential and the “shopping” experience is fairly straightforward.

Most lease agreements state that the lessee (the one leasing the equipment) is usually responsible for routine maintenance while the lessor (the equipment owner) is responsible for major repairs and replacements. However, these responsibilities can vary depending on the agreement, so it is important to read any lease agreement closely or have it reviewed by a legal professional if certain sections are unclear.

Buying construction equipment, like any large purchase, typically entails a large down payment and regular monthly payments. Interest rates vary depending on the credit history of the purchaser and other variables. Some construction equipment dealerships or manufacturers may offer attractive financing terms as a means of sweetening the deal for buyers.

Leasing construction equipment usually requires a smaller upfront cost—if any—and consistent lease payments. After the end of the lease term, lessees usually can either (a) opt to upgrade their equipment with a new lease agreement, (b) purchase the leased equipment at its market value at that time, or (c) simply turn in the equipment and walk away.

Another option is a specialized lease arrangement called a “$1 buyout lease”—in which a lessee has the option to buy the equipment at the end of the lease agreement for $1. These leases operate more as a financing option, with the lessee paying larger payments with minimal, if any, upfront cost.

While leasing construction equipment tends to be less expensive upfront and in terms of monthly payments, this is the case because you’re really only paying for the use of the equipment, the cost of depreciation, and interest. And sure, it’s less expensive every month to lease equipment, but there’s no ownership at the end of the lease agreement term and thus no opportunity for resale.

When you purchase equipment, you're responsible for providing full insurance coverage while you own the equipment with various coverage minimums during the financed term. The types of coverage required typically include:

- Liability, or the insurance that covers injuries for those operating the equipment or injured by it.

- Physical damage, or coverage in case the equipment is damaged or stolen.

- Business interruption—insurance that covers lost revenue due to the equipment being out of commission or stolen.

In contrast, leasing agreements for construction equipment often include some level of insurance, such as liability and physical damage. However, this largely depends on the specifics of the lease agreement and the type of construction equipment involved—making understanding your lease agreement essential in order to understand your insurance responsibilities.

When you purchase construction equipment, you can deduct a portion of the cost of the equipment each year as an expense on your taxes. The amount of depreciation you can claim will depend on the type of equipment and its useful life.

You may also be able to claim a Section 179 deduction for the cost of the equipment in the year you purchase it. This deduction allows you to deduct the full cost of the equipment in the year you purchase it, rather than depreciating it over its useful life. For 2023, the maximum deduction under Section 179 rose to $1,160,000.

When you lease construction equipment, you will typically be able to deduct the lease payments as an expense on your taxes. However, you will not be able to depreciate the equipment as you do not own the equipment.

In some cases, you may be able to claim a Section 179 deduction for the cost of the equipment in the year you lease it. This is only possible if you are leasing the equipment for a short period.

Buying construction equipment makes sense for long-term usage when the equipment is integral to your operations. Companies with the financial strength to front the down payments (or outright cost) and maintenance costs often benefit from purchasing.

Purchasing construction equipment is also the way to go if your company is looking to maximize your tax deductions over the life of the equipment.

Lastly, if your company would prefer to have maximum control over the use of the equipment, buying your construction equipment makes the most sense. With equipment purchased, this means you can do whatever you want with it or to it—including modifying it, renting it out, or selling it. Also, keep in mind that many construction equipment models, if properly maintained, hold their value for a fairly long time!

There are many reasons why leasing your construction equipment makes more sense than buying it. If the nature of your construction projects varies or is in flux, leasing the specialized equipment for certain projects makes sense. Also, if your company needs to remain immensely nimble, leasing construction equipment is a great way to minimize your equipment responsibilities over time—including reducing risks inherent in hefty equipment investments or being able to pivot into different specializations.

Leasing construction equipment is also an attractive option for construction companies with minimal cash flow. New companies may lease some equipment while they’re getting started so as to keep costs low and still have access to the machinery they need to generate revenue.

Whether you’re looking for construction equipment for sale or lease, you can find thousands of models near you with help from your friends at My Little Salesman. Since 1958, My Little Salesman has been connecting buyers and sellers (and lessors) of construction equipment, commercial trucks, and much more. Using our user-friendly search filters, you can quickly find your next piece of construction equipment to help you get the job done on time and within your budget.